Historical Overview and Performance

The Nikkei 225 is the leading stock market index in Japan, representing the performance of the top 225 publicly traded companies on the Tokyo Stock Exchange. It is widely regarded as a barometer of the Japanese economy and a key indicator of global market sentiment.

The index was established in 1950, initially comprising 226 companies. Over the years, it has undergone several revisions, with the number of constituents reduced to 225 in 1983. The index is calculated using a price-weighted average, meaning that the share prices of each component company are directly reflected in the index value.

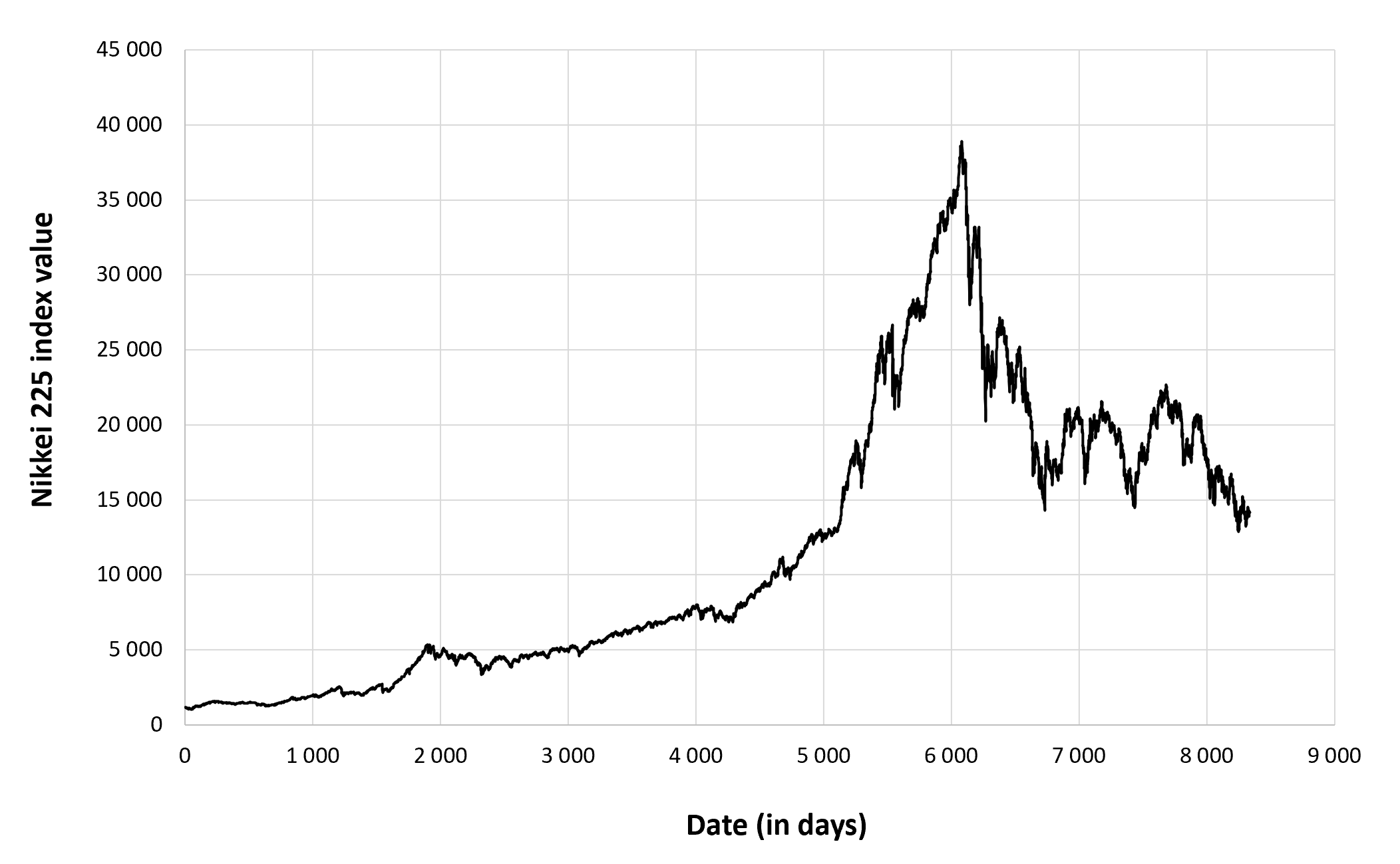

Performance over Time, Nikkei 225

The Nikkei 225 has experienced significant fluctuations over its history, reflecting the economic cycles and market events that have shaped Japan’s economy. In the early years, the index experienced rapid growth, reaching a peak of over 38,000 points in 1989 during the Japanese asset price bubble. However, the bubble burst in 1990, leading to a prolonged period of decline known as the “Lost Decade.”

During the 2000s, the index gradually recovered, but it was again hit hard by the global financial crisis of 2008. In recent years, the Nikkei 225 has benefited from the Bank of Japan’s aggressive monetary policy, reaching a new record high of over 30,000 points in 2021.

Composition and Sector Analysis: Nikkei 225

The Nikkei 225 index is composed of 225 of the largest and most actively traded companies listed on the Tokyo Stock Exchange’s First Section. These companies represent a wide range of industries, including manufacturing, financial services, consumer goods, and technology.

The weightings of the companies in the Nikkei 225 index are based on their market capitalization. The largest companies, such as Toyota Motor Corporation and Sony Group Corporation, have the greatest impact on the index’s performance.

Sector Weightings

The Nikkei 225 index is heavily weighted towards the manufacturing sector, which accounts for over 50% of the index’s weight. Other significant sectors include financial services, consumer goods, and technology.

- Manufacturing: 52.4%

- Financial services: 19.2%

- Consumer goods: 13.1%

- Technology: 10.5%

- Other: 4.8%

The sector weightings of the Nikkei 225 index have changed over time, reflecting the changing economic landscape of Japan. In the past, the manufacturing sector had a much larger weight in the index, but its importance has declined in recent years as the Japanese economy has become more service-oriented.

Economic Factors and Market Influences

The Nikkei 225 index is influenced by various economic factors and market events. These include domestic economic conditions, such as GDP growth, interest rates, and inflation, as well as global market trends and geopolitical developments.

GDP Growth

The Nikkei 225 index tends to perform well during periods of strong economic growth. This is because higher economic growth leads to increased corporate profits, which in turn can boost stock prices. Conversely, periods of slow economic growth or recession can lead to lower corporate profits and a decline in the index.

The Nikkei 225 index has been on a rollercoaster ride in recent months, reflecting the uncertainty surrounding the global economy. Some analysts believe that the index is due for a correction, while others believe that it has room to run.

Amidst this volatility, one thing is for sure: the Nikkei 225 is a bellwether for the Japanese economy, and its performance will be closely watched by investors around the world. Like the mad king who got lost in his own labyrinth, the Nikkei 225 seems to be searching for direction.

But even in its confusion, the index remains a symbol of Japan’s economic resilience.

Amidst the financial hubbub, the Nikkei 225 index had remained stubbornly stagnant, its ascent stifled by a lingering malaise. News of a French singer’s untimely demise cast a pall over the trading floor, a poignant reminder of the fragility of life.

Yet, the market’s heartbeat resumed its relentless rhythm, the Nikkei 225’s path determined not by mortal affairs but by the whims of global economies.

Amidst the bustling metropolis, the Nikkei 225 soared like a celestial phoenix, its index painting a vibrant tapestry on the skyline. As investors watched in awe, one name whispered through the corridors of finance: Fabrizio Laurenti. A master strategist with an uncanny ability to navigate the treacherous waters of the market, Laurenti’s influence extended beyond mere numbers, shaping the very trajectory of the Nikkei 225 and etching his name into the annals of financial history.

The Nikkei 225, a barometer of Japanese economic health, has been on a roller coaster ride in recent weeks. But even as investors grapple with uncertainty, they can find solace in the enduring popularity of “Game of Thrones.” The epic fantasy series, which airs on HBO, has captivated audiences worldwide.

To catch the latest episode, tune in what time is game of thrones tonight. Meanwhile, the Nikkei 225’s volatility is likely to continue as investors navigate a complex global economic landscape.

The Nikkei 225, an index of the Tokyo Stock Exchange, has been on a steady upward trajectory, buoyed by strong corporate earnings and positive economic data. But as the index approaches its all-time high, some investors are beginning to wonder if it’s time to take profits.

After all, as the saying goes, even an old french coin can lose its value if it’s not properly cared for. And the Nikkei 225 is no exception.